Last updated on 2025/05/06

Rich Dad Poor Dad Summary

Robert T. Kiyosaki

Mindset Shift: Building Wealth Through Financial Education

Last updated on 2025/05/06

Rich Dad Poor Dad Summary

Robert T. Kiyosaki

Mindset Shift: Building Wealth Through Financial Education

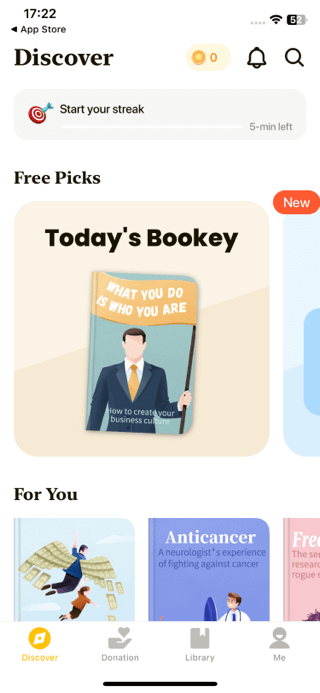

Description

How many pages in Rich Dad Poor Dad?

194 pages

What is the release date for Rich Dad Poor Dad?

"Rich Dad Poor Dad" by Robert T. Kiyosaki is not just a personal finance book; it’s a revelatory journey through the contrasting mindsets of two father figures: one wealthy and one struggling financially. Through engaging anecdotes and powerful lessons, Kiyosaki challenges conventional beliefs about money, work, and education, urging readers to redefine their understanding of wealth and financial independence. By emphasizing the importance of financial literacy, investment, and entrepreneurship, he empowers individuals to take control of their financial futures, making this book an essential read for anyone seeking to escape the rat race and build real wealth. Join Kiyosaki in discovering how to shift your perspective on money and unlock the secrets to achieving financial freedom.

Author Robert T. Kiyosaki

Robert T. Kiyosaki is an influential entrepreneur, businessman, and author renowned for his groundbreaking insights into personal finance and wealth building. Born on April 8, 1947, in Hilo, Hawaii, Kiyosaki gained fame with his bestselling book "Rich Dad Poor Dad," which contrasts the financial philosophies of his two father figures—his biological father, who held a conventional education and career, and his best friend’s father, who embraced entrepreneurial ventures and investment strategies. An advocate for financial literacy, Kiyosaki's teachings emphasize the importance of cultivating assets, understanding cash flow, and shifting mindsets towards wealth creation, making him a charismatic figure in the realms of personal finance and self-improvement.

Rich Dad Poor Dad Summary |Free PDF Download

Rich Dad Poor Dad

Chapter 1 |

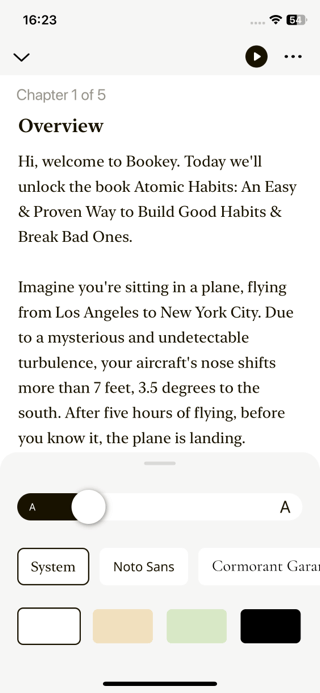

In "Rich Dad Poor Dad," Robert Kiyosaki shares his experience growing up with two father figures: one a highly educated individual with a strong secure job, and the other a less formally educated man who ultimately became very wealthy. Through their contrasting beliefs about money, Kiyosaki learns invaluable life lessons that shape his understanding of financial literacy, work, and wealth creation. 1. Kiyosaki highlights the significant differences in the philosophies of his two dads regarding money. The “poor dad” emphasized conventional wisdom about education and job security, suggesting that to succeed, one should excel academically to secure a well-paying job. Conversely, the “rich dad” advocated for understanding how money works, emphasizing that financial education is crucial to success. Kiyosaki reflects on how having two fathers provided him with a broader perspective. Rather than simply accepting one viewpoint, he compared their contrasting philosophies, which allowed him to cultivate his own understanding. 2. A key insight from the narrative is that the way we think about money directly influences our financial outcomes. Kiyosaki notes that, while both fathers worked hard, their mindsets shaped their financial trajectories. For instance, the poor dad often said phrases like “I can’t afford it,” which limited his mental framework. In contrast, the rich dad encouraged asking, “How can I afford it?” This shift in mindset helps to foster creativity and problem-solving, reinforcing the idea that one’s thoughts can empower or limit one’s financial journey. 3. Another principle Kiyosaki underscores is the necessity of financial education. Traditional schooling equips students with academic knowledge but largely neglects financial literacy. As a result, many who excel in conventional wisdom—such as bankers and doctors—still struggle financially because they lack understanding of how to manage money and build wealth. Kiyosaki warns against relying solely on formal education for financial success, emphasizing the importance of self-education regarding finances. 4. The contrasting attitudes toward risk and entitlement between the two dads provide further critical lessons. The rich dad viewed financial self-reliance as vital and rejected the notion of an “entitlement” mindset, while the poor dad leaned toward a protective view of job security and benefits. Kiyosaki advocates for active financial engagement and risk management, understanding that wealth is often built through calculated risks rather than a passive acceptance of the status quo. 5. Kiyosaki also notes the power of self-identification in shaping one’s financial destiny. The rich dad taught him to recognize the difference between being “broke,” a temporary state, and being “poor,” a permanent mindset. By internalizing a positive financial identity, individuals can work toward wealth rather than resigning themselves to financial hardships. In conclusion, Kiyosaki reflects on how his childhood experiences shaped his financial philosophy. He decided to follow the teachings of his rich dad from a young age, learning principles that resonate deeply in today's society. Through this narrative, he introduces six key lessons from his rich dad, each serving as an essential guidepost for achieving financial literacy and independence. These lessons include the importance of not working for money but rather letting money work for you, the necessity of teaching financial literacy, and the understanding that building wealth is an ongoing, proactive process. These principles aim to empower readers in their financial journeys, encouraging them to think critically about their attitudes toward money and investment.

Chapter 2 |

In Chapter 2 of "Rich Dad Poor Dad," Robert Kiyosaki introduces fundamental principles that shape his views on money and wealth, particularly through the narratives of two contrasting father figures—his biological father, represented as the "poor dad," and Mike's father, portrayed as the "rich dad." The chapter unfolds a series of events that initiate Kiyosaki's journey in understanding financial literacy and the mindset necessary for building wealth. 1. Understanding Wealth Aspirations: The chapter begins with a young Kiyosaki, deeply affected by being labeled a "poor kid" when compared to his affluent classmates. His desire to be wealthy is sparked by envy as he observes their lifestyle, which motivates him to seek answers from his father. Kiyosaki’s father responds with a simple yet profound instruction: "If you want to be rich, you have to learn to make money." This sets the stage for his journey into financial education. 2. The Birth of Entrepreneurship: Teaming up with his friend Mike, Kiyosaki decides to explore ways to make money. They creatively embark on a business venture by collecting toothpaste tubes to create molds, naively believing they could produce money through their efforts. Although their venture ends in disillusionment when they discover that the process resembles counterfeiting, it teaches them the importance of initiative and creativity in entrepreneurial endeavors. 3. The Value of Experience Over Money: After being dissuaded from their initial idea, Kiyosaki and Mike begin working for Mike’s dad. The low pay (10 cents an hour) proves frustrating yet enlightening. Mike’s father adopts an unconventional teaching approach: instead of providing direct instruction, he emphasizes hands-on experience, illustrating the lesson that real education about money comes from active participation in the financial world, rather than traditional schooling. 4. Emotional Intelligence in Financial Decisions: A pivotal lesson occurs when Kiyosaki confronts Mike's dad about his dissatisfaction with the pay. Rich Dad addresses Kiyosaki's feelings directly, suggesting that emotions such as fear and desire often cloud people's judgment regarding money. He teaches that true financial wisdom comes from understanding one's emotions, which frequently dictate actions, such as the tendency to work for money simply to escape fear rather than seeking deeper financial understanding and opportunities. 5. Creating Money Instead of Working for It: Kiyosaki learns that while the poor and middle class work for money, the rich have money working for them. This principle underscores the necessity of financial education, strategic thinking, and creativity. By offering to teach them how to leverage their skills and experiences instead of merely trading time for money, Rich Dad encourages them to think innovatively about wealth creation. 6. Recognizing the Rat Race: Kiyosaki’s narrative elaborates on the "rat race," symbolizing the cycle of working to earn money only to pay bills, leading to a life of financial struggle masked as job security. Rich Dad warns that without breaking free from this cycle—by learning to make money work for them—individuals remain trapped in perpetual financial dependency and insecurity. 7. Illusion of Money and its Real Value: Rich Dad discusses the illusion of money, emphasizing that much of what people strive for is controlled by societal fears and desires surrounding wealth. By leveraging financial knowledge, Kiyosaki learns that true value lies in securing opportunities and understanding the mechanics of wealth, rather than simply chasing after cash. The chapter ultimately serves as a powerful introduction to Kiyosaki's philosophy on financial literacy. Through experiences and lessons imparted by Rich Dad, Kiyosaki becomes aware of the importance of entrepreneurship, the role of emotional intelligence in financial decisions, and the necessity of continuously educating oneself about money. Kiyosaki concludes that success is rooted in the ability to understand and manipulate one's financial destiny, rather than being a passive participant in the economy.

Key Point: Creating Money Instead of Working for It

Critical Interpretation: Imagine standing at a crossroads in your life, with one path leading you to the conventional 9-to-5 grind and the other inviting you to explore the much more liberating journey of entrepreneurship. In Chapter 2 of 'Rich Dad Poor Dad,' Kiyosaki reveals a profound truth: while many people chase after paychecks, the wealthy cultivate skills that allow their money to work for them. This revelation can ignite a spark within you, urging you to break free from the confines of the traditional employment cycle. Instead of simply clocking in hours for a paycheck, allow your creativity and strategic thinking to flourish as you learn how to leverage your passions and experiences into profitable ventures. As you embrace this mindset, you’ll discover the thrill of crafting your financial destiny, setting yourself on a rewarding path toward independence and wealth.

Chapter 3 |

In Chapter 3 of "Rich Dad Poor Dad," Robert Kiyosaki emphasizes the critical importance of financial literacy and understanding the difference between assets and liabilities. His own journey, contrasted with that of his best friend Mike, illustrates how different financial choices can lead to vastly different outcomes. Kiyosaki retired at 47 with a substantial financial foundation, while Mike took over a strong family empire. 1. The Fundamental Importance of Financial Literacy: Kiyosaki reiterates that many people are eager to become rich but lack the foundational knowledge necessary for financial success. He references a 1923 meeting of wealthy businessmen who, despite their fortune, several decades later faced financial ruin. This serves as a reminder that wealth can be fleeting without financial intelligence. 2. The Core of Wealth Generation: Kiyosaki stresses that it’s not just about how much money you make, but rather how much you keep. He draws attention to the common plight of sudden wealth gained through lotteries or athletic careers that evaporates due to a lack of understanding of financial management. This establishes a crucial lesson: financial knowledge ensures lasting wealth. 3. Rule One – Understanding Assets and Liabilities: The essence of Kiyosaki's teachings comes back to a simple yet profound rule—know the difference between an asset, which generates income, and a liability, which incurs expenses. Unfortunately, many individuals confuse liabilities with assets, severely hindering their financial growth. 4. The Importance of a Strong Financial Foundation: Kiyosaki compares building wealth to constructing a high-rise building—one must lay a solid foundation. He criticizes the education system for not equipping students with financial acumen, leaving them ill-prepared for the realities of managing money as adults. 5. The Simplification of Complex Ideas: Kiyosaki learned financial concepts through simple drawings from his "rich dad," who initially taught him the movement of money without complex jargon or numbers. This underscores the need to teach financial literacy in accessible ways to foster understanding from a young age. 6. Cash Flow Patterns and Financial Struggles: Kiyosaki illustrates how different financial mindsets manifest in cash flow patterns across socio-economic classes. Poor individuals often find themselves trapped in a cycle of spending and debt, while wealthy individuals understand how to generate and manage income-generating assets. 7. The Rat Race Explained: A common scenario involves a couple who earn higher incomes but see their expenses balloon as they try to maintain an image of success (e.g., buying a bigger house). This cycle illustrates how the middle class often unintentionally traps themselves in a "rat race," where increased income leads to increased liabilities rather than wealth accumulation. 8. The Role of Fear and Conformity: Kiyosaki emphasizes that societal pressures and fears often lead individuals to conform and ignore sound financial advice. He urges readers to trust their instincts and challenge conventional wisdom regarding finances. 9. Wealth Versus Net Worth: Kiyosaki introduces the idea of measuring wealth by the number of days one can survive solely on cash flow from assets, distinguishing it from the traditional metric of net worth. This perspective fosters a mindset aimed at financial independence rather than mere accumulation of possessions. 10. The Pursuit of Financial Education: Ultimately, Kiyosaki encourages everyone to seek financial education actively. Wealth is not just about making money—it's about acquiring the knowledge necessary to manage it effectively. By consistently prioritizing financial literacy and strategic investments, individuals can break free from cyclical poverty and achieve true financial independence. In summary, Kiyosaki's teachings illuminate the path to financial freedom through the mastery of financial literacy and the strategic management of one’s finances. Understanding and acquiring assets while minimizing liabilities is essential for long-term wealth generation, and breaking the cycle of conformity and fear is fundamental to achieving success in personal finance.

Key Point: The Importance of Understanding Assets and Liabilities

Critical Interpretation: Imagine standing at a crossroads, your financial future stretching out before you; one path leads you towards a mountain of debt, while the other opens up to vast fields of opportunity. As you read through Chapter 3 of 'Rich Dad Poor Dad,' let the pivotal lesson sink in: recognizing the difference between assets and liabilities could be the key that unlocks your potential. You begin to see that every decision—whether purchasing a flashy new car or investing in a rental property—shapes your landscape of wealth. By prioritizing assets that generate income over liabilities that drain your resources, you start to build a solid foundation for financial independence, defining your own success on your terms instead of being a mere byproduct of societal expectations.

Chapter 4 |

In Chapter 4 of "Rich Dad Poor Dad," Robert Kiyosaki shares valuable insights about financial independence, emphasizing the importance of "minding your own business." He recalls an enlightening encounter between Ray Kroc, the founder of McDonald's, and an MBA class where Kroc provocatively posed the question, "What business am I in?" Initially assumed to be in the hamburger business, he clarified that his real business revolved around real estate. Kroc understood the integral role of property location in the success of his franchises, demonstrating the profound distinction between understanding one’s profession and one’s actual business. Kiyosaki emphasizes that financial struggle often stems from people dedicating their lives to others' businesses rather than focusing on their financial well-being. He illustrates this by contrasting the approaches of the rich and the poor, where the rich prioritize growing their asset columns, while the latter remain fixated on their income statements. Rather than seeking promotions or secondary jobs, individuals should channel their additional earnings towards acquiring income-generating assets. The rich focus on what truly counts: investments that yield steady returns, contrary to the common fixation on job security and the fear of financial risk. Moreover, Kiyosaki warns against the common misconception of equating personal possessions, like homes or cars, with true assets. Many people mistakenly believe these liabilities contribute positively to their net worth. He cautions that assets should be evaluated on their ability to generate income, rather than their purchase price or perceived value. 1. Mind Your Own Business: The core lesson encourages individuals to focus on building their own asset base rather than solely concentrating on their profession, which could inadvertently keep them financially dependent on someone else’s business. 2. Differentiate Between Profession and Business: There is a clear distinction between the job one performs and the business one operates. Professionals must develop a separate identity as business owners, striving to build an asset column independent of their day-to-day jobs. 3. Understand Assets vs. Liabilities: Kiyosaki establishes the critical need to recognize true assets as items that generate income, while liabilities drain resources. This understanding is pivotal in making informed financial decisions. 4. Long-term Wealth Building: The chapter underscores the value of patience and strategic planning in finance, advocating for building wealth over time through sound investments rather than seeking immediate gratifications that lead to financial woes. 5. Asset Acquisition Philosophy: Kiyosaki shares insights on the kinds of assets to seek, suggesting investments in businesses, real estate, stocks, and intellectual property that warrant managerial independence and income generation. 6. Delayed Gratification: He contrasts the behaviors of the wealthy against those of the poor and middle class in terms of consumption patterns, where the former invest first to secure financial freedom before indulging in luxuries, whereas the latter often succumb to debt for immediate pleasures. 7. Financial Literacy: A consistent emphasis on the necessity of financial literacy is apparent throughout the chapter, as Kiyosaki stresses understanding accounting and cash management for better investment analysis and success in business pursuits. In conclusion, "minding your own business" encapsulates the essential practice of focusing on personal financial growth through astute investment in true assets. This approach not only fosters financial stability but ultimately leads to wealth creation and security through disciplined financial habits and informed decision-making. The teachings derived from Kiyosaki's experiences with his "rich dad" offer a profound perspective on achieving financial independence, reminding readers of the long-term rewards that come from making calculated investments rather than surrendering to consumerism or temporary employment fears.

Key Point: Mind Your Own Business

Critical Interpretation: Imagine waking up each day with a sense of purpose, knowing that your time and efforts are dedicated to building your own financial empire rather than simply contributing to someone else's success. Inspired by Kiyosaki's core lesson, you could revolutionize your approach to finance by turning your attention to acquiring income-generating assets. This shift in focus empowers you to consciously cultivate your financial well-being, investing not just your money but also your energy and creativity into ventures that foster sustainable wealth. As you begin to understand the profound difference between your profession and your true business, a world of possibilities opens up, allowing you to break free from the constraints of job security and embrace the freedom that comes from financial independence. Each decision you make—from allocating your resources to prioritizing investments—could bring you closer to a life not defined by paycheck-to-paycheck living, but rather by the comfort of sustained growth and the thrill of ownership, leading to a future where options and opportunities abound.

Chapter 5 |

Chapter 5 of "Rich Dad Poor Dad" presents critical insights into the interplay between taxation, wealth, and corporate structures through the contrasting perspectives of the author’s two influential father figures. The narrative draws on historical context, offering a comprehensive exploration of how taxation originated and evolved over time. 1. The Robin Hood Myth: The chapter begins with a discussion on the Robin Hood legend, highlighting the misguided belief that wealth redistribution — taking from the rich to benefit the poor — is a viable solution to poverty. The author’s rich dad argues that this mentality disproportionately burdens the middle class with taxes, ultimately hurting those it intends to help. The middle-class is increasingly taxed, while the wealthy utilize strategies to mitigate their tax burdens. 2. Historical Context of Taxes: The chapter traces the origins of taxation in England and America, noting that income tax laws initially targeted the wealthy but eventually ensnared the middle class. The transition from temporary taxes during wars to steady income taxes illustrates how government dependency on tax revenue has expanded. The narrative reflects on how excessive government spending fosters a taxing environment that harms the very citizens it aims to assist. 3. Corporate Advantage: A significant theme in this chapter is the power that corporations provide to the wealthy. Investments are shielded through corporations, allowing the affluent to limit their financial risks and liabilities. The author emphasizes that understanding the legal and financial structures of corporations can provide substantial advantages over traditional employment, where individuals typically have little control over their tax burdens. 4. Financial Literacy and Intelligence: Rich Dad stresses the importance of financial education, suggesting that those who lack knowledge about money management and investment strategies are disenfranchised in their financial pursuits. Kiyosaki identifies four areas critical to achieving financial independence: accounting, investing, understanding markets, and knowledge of law. Mastery in these domains allows individuals to utilize financial vehicles like corporations to safeguard assets and optimize tax situations. 5. The Struggle Against Taxation: Kiyosaki recounts the struggle many face against the taxman, who continuously seeks a larger share of income. He emphasizes that the wealthy do not passively accept higher taxes; instead, they actively seek ways to minimize tax liabilities through strategic planning and legal frameworks. The author cautions against the fear of government audits, which can deter individuals from claiming rightful deductions and utilizing advantageous financial structures. 6. The Road to Wealth: The realization of the value of “mind your own business” leads Kiyosaki to form his corporation, which aligns with Rich Dad's lessons. By embracing this entrepreneurial mindset, he shifts focus from mere employment income to building assets that generate passive income. This transition underscores the importance of not only working for money but making money work for oneself. 7. Financial Independence Through Knowledge: The chapter concludes with a strong call to action for readers to expand their financial knowledge. Acquiring financial intelligence encompasses mastering accounting, investment strategies, market dynamics, and legal frameworks governing corporations. The synergy of these skills creates a robust foundation for financial success, transforming one's approach from being an employee beholden to taxes, into a savvy investor harnessing the benefits of corporate structures. In summary, Chapter 5 provides a poignant analysis of the dynamics of wealth, taxation, and corporate power, illustrating the essential lessons on financial intelligence that can lead to true financial freedom.

Key Point: Mastering Financial Literacy and Intelligence

Critical Interpretation: Imagine standing at the threshold of a new world where you're no longer confined by the limitations of traditional employment. By embracing the lessons in financial literacy, you can arm yourself with knowledge that not only empowers you but also transforms your relationship with money and taxation. As you delve into the realms of accounting, investing, and understanding the market, you're equipping yourself to make informed decisions that can shield your assets and maximize your financial potential. This knowledge instills confidence, allowing you to transition from merely working for money to making your money work for you. You begin to see that financial intelligence isn’t just about numbers; it’s about the power to create wealth on your own terms, liberating you from the heavy burden of taxation that weighs down so many. As you navigate through this journey, you’ll find that with each step, you’re not just pursuing financial success, but crafting a life of independence and freedom.

Chapter 6 |

In Chapter 6 of "Rich Dad Poor Dad," Robert Kiyosaki imparts valuable lessons underscoring the essential attributes of financial intelligence and the mindset vital for achieving success. He begins by recounting the historical narrative of Alexander Graham Bell, whose invention of the telephone was dismissed by the president of Western Union, ultimately leading to tremendous wealth generation in the telecommunications sector. This comparison sets a tone of contrasting attitudes toward innovation and risk. 1. The Importance of Self-Confidence: Kiyosaki emphasizes that self-doubt is a pervasive barrier for many individuals, hindering their potential for success. While technical knowledge is crucial, self-confidence and the courage to act on what one knows can determine one’s future. He notes that, often, boldness and daring outweigh intelligence in achieving financial success. 2. Embracing Change: Kiyosaki highlights the necessity of developing a financial IQ amidst rapid societal and technological changes. He asserts that the current era offers unprecedented opportunities for wealth creation, likening it to a transformative age. Those willing to adapt and innovate can prosper, while those who cling to outdated ideas may find themselves struggling and left behind. 3. Learning and Feedback: Drawing from his teaching experiences, Kiyosaki employs the game CASHFLOW to illustrate money management concepts. Rather than presenting lectures, he believes in using games to provide instant feedback on financial behavior. He describes how some participants resist the lessons encapsulated in the game, reflecting a broader reluctance to confront personal financial realities. 4. Recognizing Financial Options: The game serves as a metaphor for real life, demonstrating how a keen understanding of finance opens multiple pathways for solutions and opportunities. Those adept at recognizing and leveraging various financial options can escape the "Rat Race"—a term Kiyosaki uses to describe a cycle of working hard without gaining true financial freedom. 5. The Dichotomy of Wealth: Kiyosaki points out that mere possession of money does not guarantee financial success. He observes that many people with substantial wealth fail to advance financially because they lack understanding and strategic insight into their investments. In summary, Chapter 6 of "Rich Dad Poor Dad" advocates for the cultivation of financial intelligence, encourages embracing change and innovation, underscores the importance of self-confidence in achieving goals, and highlights the necessity of recognizing diverse financial opportunities. Kiyosaki’s insights frame a compelling argument for enhancing one’s financial acumen as a prerequisite for achieving lasting wealth and success in an ever-evolving economic landscape.

Key Point: The Importance of Self-Confidence

Critical Interpretation: Imagine standing at the starting line of a race, heart pounding, with the finish line barely visible ahead. In this moment, you realize that what truly propels you toward success is not just the knowledge you’ve garnered or the strategies you've devised but the unwavering belief in yourself. Kiyosaki's insights serve as a powerful reminder that self-confidence can dissolve the chains of self-doubt that have held you back. Embracing the courage to take bold steps, to trust your instincts, and to act even when fear looms large is what separates the dreamers from the achievers. By harnessing this self-belief, you equip yourself to seize opportunities in finance and beyond, transforming potential obstacles into stepping stones on your journey toward financial freedom and personal fulfillment.

Chapter 7 |

In Chapter Seven of "Rich Dad Poor Dad," titled "Work to Learn - Don't Work for Money," Robert Kiyosaki emphasizes the importance of acquiring a diverse skill set rather than focusing solely on monetary gain. The chapter opens with an anecdote involving a young reporter who, despite her talent in writing, feels stagnant in her career because she remains confined to her job at a newspaper. Kiyosaki suggests that she consider acquiring sales and marketing skills to significantly boost her income, which she rejects due to her belief that her education should shield her from what she perceives as menial work. This interaction serves as a springboard for Kiyosaki to discuss the reality of financial success. Despite the abundance of highly educated and talented individuals, many still struggle to earn a decent income. He highlights that financial intelligence, comprising skills in accounting, investing, marketing, and law, is crucial for accumulating wealth. Most individuals primarily know how to work hard rather than leverage their skills efficiently. Kiyosaki reiterates a critical point: people often need to learn one more skill to propel their earnings. He argues that instead of seeking job security through specialization—a mindset instilled by his educated father—one should strive to gain a broad knowledge across various fields. This approach allows for greater adaptability in a rapidly changing job market. Reflecting on his own experiences, Kiyosaki recalls how he left a promising career with Standard Oil to join the Marine Corps, motivated by a desire to lead and manage people, demonstrating a clear commitment to personal growth over immediate financial stability. He contrasts this with the mindset of his educated dad, who emphasized job security and specialization, leading to a potentially precarious financial situation after losing his government job. Highlighting the futility of being overly specialized, Kiyosaki warns that many workers become trapped in cycles of job dependence, neglecting their long-term financial futures. He advocates adopting opportunities that foster learning and growth, such as second jobs or side hustles that cultivate new skills. This approach not only broadens one’s expertise but can also contribute to long-term financial independence. Reasserting his belief against the conventional wisdom preached by education systems, Kiyosaki promotes the idea that those willing to learn and adapt will thrive in today’s economy. He cites examples of individuals who have successfully diversified their skill sets and leveraged them for success, emphasizing that thriving financially often requires more than just superior technical skills; it also necessitates strong sales and communication abilities. The chapter closes with reflections on the attitudes of both his rich dad and educated dad toward money and generosity. Kiyosaki illustrates that giving is an essential principle in building wealth and financial intelligence. While his rich dad embodied the philosophy of giving to receive, his educated dad was caught in the cycle of earning before giving. Kiyosaki concludes by advocating for a balance between being a savvy capitalist and a socially responsible individual, emphasizing the need for educational reform to address the widening gap between the wealthy and the less fortunate in society. Thus, the key lessons from Kiyosaki’s chapter can be summarized as follows: 1. Broaden Your Skill Set: Seek knowledge in diverse areas, especially sales and marketing, to enhance your earning potential. 2. Prioritize Learning Over Immediate Income: Look for jobs that offer skills and experiences rather than solely focusing on salary. 3. Adapt to Change: Embrace a mindset of adaptability and continuous learning to thrive in an ever-evolving job market. 4. Understand Financial Intelligence: Knowledge in accounting, investing, marketing, and law can significantly aid in wealth accumulation. 5. Embrace Generosity: Recognize that giving can lead to receiving, and engage in teaching and sharing knowledge as a route to personal and financial growth.

Key Point: Broaden Your Skill Set

Critical Interpretation: Imagine waking up each day with a sense of purpose, not just tethered to the paycheck that arrives at the end of the month, but invigorated by the diverse skills you have cultivated. Instead of being confined by the limits of your current role, picture yourself stepping into different arenas—learning the art of negotiation, mastering marketing strategies, or even diving into the nuances of investment. This chapter invites you to broaden your horizons, urging you to see the value in experiences that enrich you beyond immediate financial gain. By doing so, you empower yourself to adapt in a rapidly changing job market, ensuring that your income isn’t just a reflection of your current job title but rather a reward for your continuous growth and curiosity. Every skill you acquire becomes a tool in your arsenal, opening new doors and leading you toward opportunities that align with not only your financial goals but your passion for learning and personal development.

Chapter 8 |

In chapter eight of "Rich Dad Poor Dad" by Robert T. Kiyosaki, the author addresses the obstacles that financially literate individuals may face in their journey toward financial independence. Despite having knowledge about finance, many people struggle to build wealth due to a range of psychological and behavioral barriers. Kiyosaki identifies five primary reasons that can hinder the creation of substantial asset columns capable of generating cash flow for freedom and abundance. The first reason is fear. Fear of loss is universal, affecting both the rich and the poor, but the crucial distinction lies in how individuals respond to that fear. Many poor individuals avoid risk entirely, which restricts their financial growth. Kiyosaki suggests embracing fear as a natural part of life and emphasizes that both winning and losing are integral to financial success. He advocates starting investments early to harness the power of compound interest and views investing not as a zero-sum game but as a process where learning through failure is essential. Just like the Texans who confront challenges with pride and resilience, overcoming fear involves recognizing risks while taking calculated steps toward wealth accumulation. The second reason is cynicism. Kiyosaki illustrates that doubts can paralyze individuals, leading them to miss opportunities. He reflects on a friend's decision to back out of a real estate investment due to external negativity, demonstrating how cynicism can cause individuals to shy away from potentially profitable ventures. Kiyosaki argues that while criticism can suppress growth, analysis can uncover opportunities. He encourages readers to silence their inner "Chicken Little" and take bold steps in pursuing investments rather than being deterred by fears and doubts. Laziness constitutes the third obstacle. Kiyosaki describes how people can become overly busy while avoiding important tasks, using the excuse that they don't have time. This misplaced busyness often stems from a fear of confronting financial realities. He emphasizes the need for desire and ambition as motivators to push through laziness. By asking "What’s in it for me?" individuals can ignite their intrinsic motivation to improve their financial circumstances. The fourth obstacle is bad habits. Kiyosaki stresses that financial habits are crucial to success, often more so than formal education. He contrasts the financial behaviors of his poor dad, who prioritized paying bills, with his rich dad, who chose to pay himself first. By implementing a habit of prioritizing personal financial gain, individuals can cultivate stronger financial health. Kiyosaki underscores that one’s financial habits dictate their overall financial health more than external circumstances. Finally, arrogance represents the fifth impediment. Kiyosaki defines arrogance as a combination of ignorance and ego, where individuals believe they know enough about finance to dismiss further education. He warns against the dangers of not acknowledging one's ignorance and the losses that can result from overconfidence in financial matters. Embracing a mindset of continuous learning and seeking guidance from knowledgeable experts is vital for effectively managing finances. By addressing these five obstacles—fear, cynicism, laziness, bad habits, and arrogance—Kiyosaki offers a framework for overcoming psychological barriers on the path to financial independence. Readers are encouraged to confront their fears, challenge cynicism, ignite their ambitions, cultivate positive financial habits, and remain humble in their pursuit of knowledge. These principles serve to illuminate the essential mindset needed to build wealth and achieve the life of freedom and abundance that many aspire to attain.

Chapter 9 |

In Chapter 9 of "Rich Dad Poor Dad," Robert Kiyosaki emphasizes the personal journey towards financial independence, blending determination with practical strategies. He illustrates that while the path to wealth is not necessarily easy, it is achievable with the right mindset and actions. 1. Purpose Above All: Kiyosaki stresses the importance of having a compelling reason to pursue wealth. He shares his own motivations rooted in emotional desires for freedom and a better life, asserting that without strong reasons, the challenges of financial growth may overwhelm one’s ambition. He believes that financial freedom is a deeply personal drive, stemming from a desire to escape conventional job roles and limitations. 2. Daily Choices: Acknowledge the power of choices in shaping one’s financial destiny. Kiyosaki reflects on how each dollar spent can signal a choice, influencing whether one remains rich, poor, or middle class. He suggests that many people opt for convenience over learning about managing their finances effectively, thus perpetuating a cycle of dependency on employment rather than cultivating financial intelligence. 3. Invest in Knowledge: He advocates for prioritizing education about finance and investment above leisure expenditures. Kiyosaki recounts his experiences with various educational seminars and financial literature, asserting that investing in one's mind is crucial to enhancing financial acumen, which ultimately leads to more informed investments. 4. Network with Intention: Choosing one’s associates wisely is framed as a critical element of financial success. Kiyosaki advises surrounding oneself with individuals who inspire learning and curiosity about money, rather than those who dwell in negativity about finances. Engaging with financially savvy individuals opens up opportunities for mentorship and insight into wealth-building strategies. 5. Mastering Systems: Financial competency requires the mastery of specific systems or formulas for making money. Kiyosaki shares how he learned to navigate the real estate market through experience, underscoring the necessity of adapting and evolving one’s strategies to remain effective in changing markets. Continuous education in new approaches can lead to significant financial gains. 6. Prioritize Self-Discipline: The principle of "pay yourself first" emphasizes the importance of financial discipline. Kiyosaki illustrates how self-discipline can be the differentiating factor between financial stability and instability, urging readers to take control of their finances by prioritizing savings and investment ahead of expenses. 7. Valuing Professional Advice: Engaging professionals such as accountants, brokers, and real estate agents, and compensating them well can enhance financial success. Kiyosaki believes that investing in knowledgeable advisors can yield far greater returns, as they provide vital information and insights necessary for wealth accumulation. 8. Leveraging Opportunities: Kiyosaki introduces the concept of being "an Indian giver," where one seeks to recover their investment while still gaining assets over time. This approach illustrates the importance of assessing investments not just for their immediate return, but for their long-term sustainability and potential growth. 9. Focusing on Wealth Creation: The chapter insists on the paradigm shift required to prioritize acquiring assets that generate passive income, as opposed to liabilities that cost money. He encourages that luxuries should result from asset growth rather than immediate borrowing against future earnings. 10. The Influence of Role Models: Kiyosaki concludes by underscoring the power of having mentors or heroes whose paths can be emulated. Learning from successful figures in business and investment can provide a roadmap toward achieving similar success, as they exemplify the ease and proficiency of financial mastery. Through these principles, Kiyosaki empowers readers to awaken their financial genius and offers practical steps that encourage a proactive approach to building wealth while emphasizing the essential mindset adjustments required for success.

Chapter 10 |

In Chapter 10 of "Rich Dad Poor Dad," Robert Kiyosaki emphasizes the importance of taking actionable steps toward financial independence while blending philosophy with practical strategies. His insights cater to those looking for clear guidance to enhance their financial well-being. 1. Self-Assessment: Begin by evaluating your current situation. Kiyosaki stresses that continuing with ineffective strategies may lead to stagnation. By taking a break and reassessing your actions, you can identify what needs to change. 2. Seek New Knowledge: To inspire fresh ideas, explore new subjects through books or online resources. Kiyosaki shares how he discovered valuable investment techniques in unexpected places and encourages readers to actively pursue knowledge that expands their understanding. 3. Take Business Action: Once you’ve acquired new knowledge, it’s crucial to apply it immediately. Kiyosaki recounts his experience with tax lien certificates, showcasing how he implemented knowledge without letting skepticism deter him. 4. Learn from Practitioners: Building relationships with those who have succeeded in areas you wish to explore can provide invaluable insights. By inviting experienced individuals to lunch, Kiyosaki was able to access firsthand knowledge that streamlined his own investments. 5. Education and Constant Learning: Kiyosaki highlights the value of formal education, such as attending classes or purchasing informational materials. He asserts that his financial freedom is a direct result of continual education. Unlike skeptics who dismiss these opportunities, he urges the audience to view them as essential investments. 6. Make Offers: The author advises readers to actively engage in the real estate market by making numerous offers. He explains that without exploring multiple options, one may miss out on potential opportunities. 7. Adopt a Playful Mindset: Kiyosaki reminds readers that the process of buying and selling is akin to a game. Embracing a lighthearted attitude can combat the fear that often paralyzes prospective investors. 8. Market Observation: Regularly observing neighborhoods can unveil investment opportunities. Kiyosaki metaphorically compares this practice to jogging, where repeated exposure allows one to recognize changes and identify potential deals more effectively. 9. Value in Unexpected Places: He teaches that timing is crucial—understanding when the market represents a sale is paramount for financial success. He shares strategies for identifying undervalued assets and stressing the importance of recognizing the right conditions for profitable investments. 10. Think Big: Lastly, small thinking limits growth. Kiyosaki believes that broadening one’s vision can lead to greater opportunities. He emphasizes that even small investors can achieve substantial deals if they approach investments with the mindset of a bigger player. In the epilogue, Kiyosaki provides a compelling narrative about making wise investments to fund children's education. This illustrates how financial intelligence, rather than merely hard work, can facilitate achieving significant goals. He concludes with the reminder that the choices one makes with money today will shape their financial future—not only for themselves but also for their children. Through actionable insights and personal anecdotes, Kiyosaki advocates for a proactive approach to financial education, emphasizing that developing financial intelligence can lead to fruitful investments, wealth generation, and ultimately, a more rewarding life.